Relative CAPE Ratio for Value Investing US Sectors Since 2002 | Your Personal CFO - Bourbon Financial Management

![Yes, Virginia, There Is [More Than] Hope: Twenty years of sector rotation with Shiller's CAPE® Ratio | Natixis Investment Managers Yes, Virginia, There Is [More Than] Hope: Twenty years of sector rotation with Shiller's CAPE® Ratio | Natixis Investment Managers](https://www.im.natixis.com/images/dpcimages/ossiam-2022_380x214.jpg)

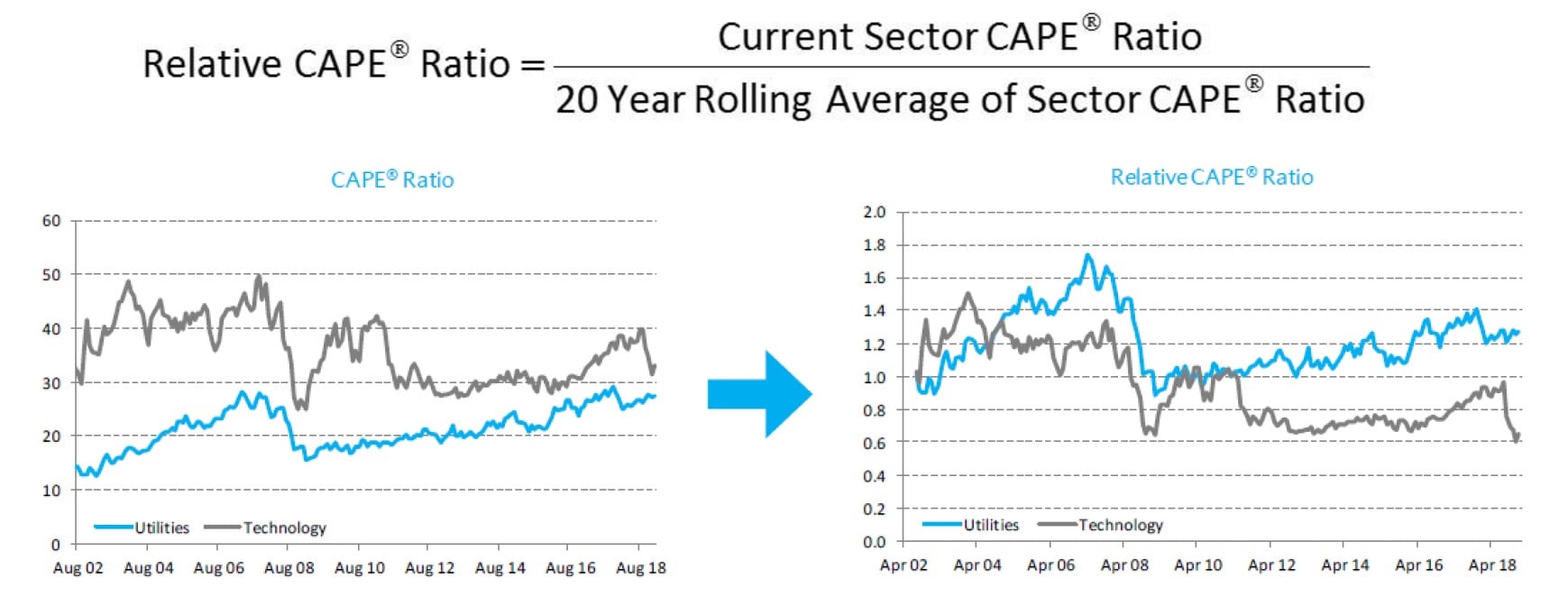

Yes, Virginia, There Is [More Than] Hope: Twenty years of sector rotation with Shiller's CAPE® Ratio | Natixis Investment Managers